Carefully explain why monetary policy is likely to be more effective in a open economy than fiscal policy

What will be an ideal response?

Expansionary fiscal policy increases interest rates, causing an exchange rate appreciation. Appreciation switches expenditures toward foreign goods because it makes them relatively cheaper, thereby increasing imports and reducing the current account balance. The expansionary fiscal policy leads to more imports, both from the rise in income and from exchange rate appreciation, which creates a feedback effect on domestic income. The shift in expenditures toward foreign goods offsets some of the increase in the demand for domestic goods and diminishes the impact of expansionary fiscal policy. In contrast, expansionary monetary policy causes the interest rate to fall and the currency to depreciate. Exchange rate depreciation switches some consumer spending from foreign goods (imports) to domestic goods, because foreign goods become relatively expensive. The effect of expenditure switching is to partially or completely offset the increase in imports caused by rising incomes. As a result, there is a more robust expansion of the domestic economy because less of the expansion of demand leaks out of the economy as an increase in imports.

You might also like to view...

Price supports increase the supply of affordable milk for U.S. families.

Answer the following statement true (T) or false (F)

A speculator who takes a long position in a market buys low and sells high, whereas a speculator who taxes a short position in a market buys high and sells low.

Answer the following statement true (T) or false (F)

Explain why the rates of death due to kidney disease and diabetes have slightly increased in the United States since 1981

What will be an ideal response?

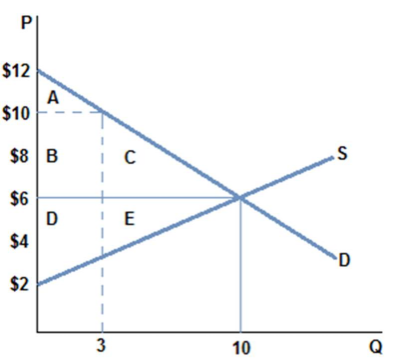

According to the graph shown, if the market is in equilibrium, consumer surplus is:

A. $30.

B. $20.

C. $50.

D. $60