Discuss the global strategic planning process.

What will be an ideal response?

Answers may vary but could include the following: Global strategic planning is a primary function of a company's managers, and the ultimate manager of strategic planning and strategy making is the firm's chief executive officer. The process of strategic planning provides a formal structure in which managers (1) analyze the company's external environments, (2) analyze the company's internal environment, (3) define the company's business and mission, (4) set corporate objectives, (5) quantify goals, (6) formulate strategies, and (7) make tactical plans. For ease of understanding, we present this as a linear process, but in actuality there is considerable flexibility in the order in which firms take up these items. In company planning meetings that one of the authors attended, the procedure was iterative; that is, during the analysis of the environments, committee members could skip to a later step in the planning process to discuss the impact of a new development on a present corporate objective. They then often moved backward in the process to discuss the availability of the firm's assets to take advantage of the environmental change. If they concluded that the company had such a capability, the committee would try to formulate a new strategy. If a viable strategy was developed, the members would then establish the corporate objective that the strategy was designed to attain. The global planning process has the same basic format as the planning process for a purely domestic firm. Most activities of the two kinds of operations are similar. It is the variations in values of uncontrollable forces that make the activities in a worldwide corporation more complex than they are in a purely domestic firm.

You might also like to view...

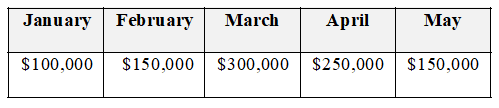

Active Life Inc., a sports equipment retailer, needs to prepare a cash budget for the first quarter of 2018. The financial staff at Active Life has forecasted the following sales figures:

Actual sales in October, November, and December 2017 were $125,000, $146,000, and $125,000, respectively. Cash sales are 40% of the total, and the rest are on credit. Under the current credit policy the firm expects to collect 60% of credit sales the following month, 30% two months after, and the remainder in the third month after the sale.

Each month, the firm makes inventory purchases equal to 45% of the of the next month’s sales. The firm pays for 40% of its inventory purchases in the same month and 60% in the following month; nevertheless, the firm enjoys a 2% discount if it pays during the same month as the purchase.

Estimated disbursements include monthly wages and other expenses representing 25% of the same month’s sales; a major capital outlay of $30,000 expected in January; a dividend payment of $25,000 in February; $40,000 of long-term debt maturing in March; and a tax payment of $60,000 in April. The interest rate on its short-term borrowing is 7%. It has a required minimum cash balance of $10,000 every month, and has an ending cash balance of $30,000 for December 2017.

Using the above information, create a cash budget for January to June 2018. The cash budget should account for short-term borrowing and payback of outstanding loans.

Using Excel’s outline feature, group the worksheet area at the top of the cash budget so that the preliminary calculations can be easily hidden or unhidden.

Ms. Elaine Benes, Active Life’s CFO, is considering three credit proposals from the firm’s supplier. In the first proposal the firm will pay 75% of its purchases in the same month and 25% in the following month; in the second proposal the firm will pay half in the same month and half in the following month; in the third proposal the firm will pay 25% of its purchases in the same month and 75% in the following month. Suppliers have offered 4%, 3%, and 2% discounts over the payments made during the same month of the purchase if the firm pays according to the first, second, and third proposals, respectively. The CFO has asked you to use the Scenario Manager to see which proposal has the lowest total interest cost.

Ms. Benes is now considering three credit policies from the firm’s customers. In the first policy the firm will sell 60% on cash and will collect 60% of the balance during the first month, and the remaining balance during the second month. In the second policy, 50% of sales will be on cash, and the firm will collect 50%, 30%, and 20% of credit sales during the first, second, and third months, respectively. The last policy consists of 40% sales on cash, and 40%, 30%, and 30% of the remaining balance will be collected during the first, second, and third months, respectively. The CFO has asked you to use the Scenario Manager to see what credit proposal has the lowest total interest cost.

Stock of the Boston Corporation has a par value of $20 . If the corporation pays a 7% dividend, compute the amount of the dividend paid to the owner of 762 shares

If the coefficient of correlation is 0.75, what is the value of the coefficient of determination?

A) 0.8660 B) 0.5625 C) 0.5916 D) 0.6123

When building a scalable system that can support new company developments what are the key factors to consider?

A. Understanding competitor products and services B. Anticipating expected and unexpected growth C. Analyzing the accessibility and availability of competitor systems D. Organizing and deploying additional resources