When we add up the total payments made to households that furnish the resources used to produce the goods and services in the economy, we are using

a. the income approach

b. the expenditure approach

c. the output approach

d. the aggregate demand approach

e. GDP product

A

You might also like to view...

Suppose you are given the following demand data for a product.PriceQuantity Demanded$1030940850760670Using the regular percentage change formula, what is the price elasticity of demand when price increases from $6 to $7?

A. Elastic B. Unelastic C. Inelastic D. Unit elastic

Who will bear the burden of a $0.05 tax placed on soda suppliers (consumer or seller) in a soda market where Qd = 225-10P and Qs = 50 + 15P?

A) Consumers pay $0.30 of the tax, bearing the burden. B) Consumers pay $0.25 of the tax, bearing the burden. C) Sellers pay $0.20 of the tax and bear the burden. D) Sellers pay all of the tax and bear the burden.

Keynesians believe a change in the money supply cannot lower the unemployment rate.

a. true b. false

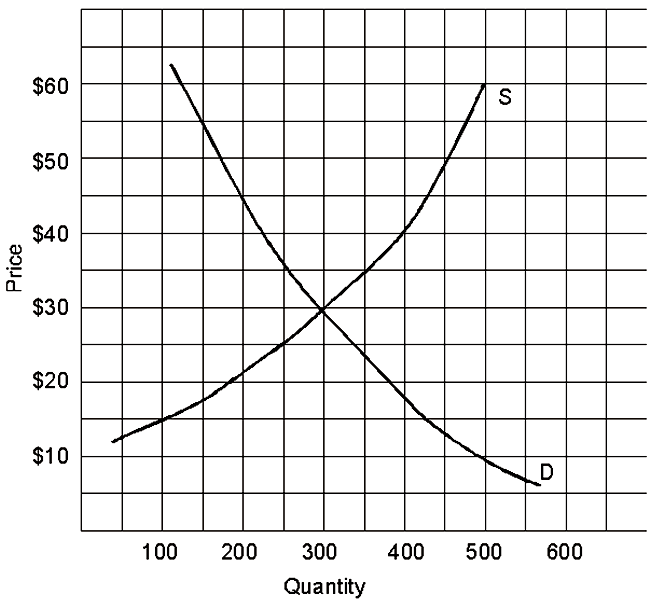

In the graph shown above, if the government set a price ceiling of $18

A. the price would rise to the equilibrium price.

B. the price would fall to equilibrium price.

C. there would be a temporary shortage, then price would rise to equilibrium price.

D. there would be a permanent shortage, at least until the price ceiling was lifted.