Who will bear the burden of a $0.05 tax placed on soda suppliers (consumer or seller) in a soda market where Qd = 225-10P and Qs = 50 + 15P?

A) Consumers pay $0.30 of the tax, bearing the burden.

B) Consumers pay $0.25 of the tax, bearing the burden.

C) Sellers pay $0.20 of the tax and bear the burden.

D) Sellers pay all of the tax and bear the burden.

A

You might also like to view...

Suppose that the government wants the burden of the cigarette tax to fall equally on buyers and sellers and declares that a $1.00 tax be imposed on each. Is the burden of the tax shared equally? Why or why not?

What will be an ideal response?

What term means an explosive and seemingly uncontrollable inflation in which money loses value rapidly and may even go out of use?

A) superinflation B) stagflation C) hyperinflation D) maginflation E) deflation

The Law of Supply insures that supply curves slope upward

Indicate whether the statement is true or false

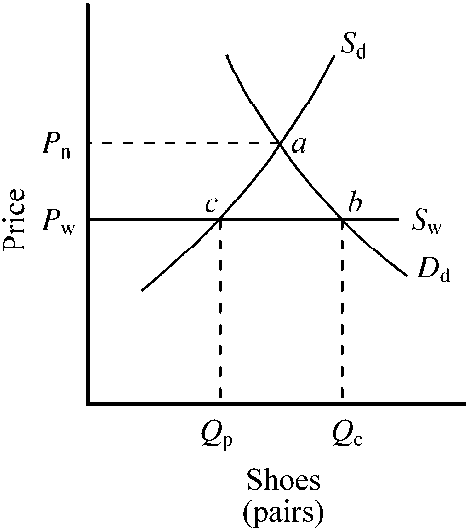

Figure 17-2

In , in the absence of trade, the domestic price of shoes is Pn. Since many foreign countries have a comparative advantage in the production of shoes, when the United States begins to trade, the domestic price will fall to the world price. When this happens, what does the quantity Qc through Qp represent?

a.

the quantity of shoes that the United States imports

b.

an increase in the world consumption of shoes

c.

the quantity of shoes that the United States exports

d.

a reduction in the world consumption of shoes