Rosewood Company made a loan of $8600 to one of the company's employees on April 1, Year 1. The one-year note carried a 6% rate of interest. What is the amount of interest revenue that Rosewood would report in Year 1 and Year 2, respectively?

A. $0 in Year 1 and $516 in Year 2

B. $129 in Year 1 and $387 in Year 2

C. $387 in Year 1 and $129 in Year 2

D. $516 in Year 1 and $0 in Year 2

Answer: C

You might also like to view...

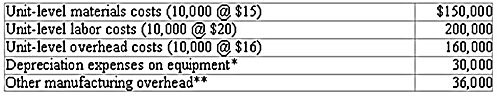

The Enhanced Products Division of Forrest Industries makes ceramic pots that are used to hold large decorative plants. During the current year, the division produced 10,000 pots and incurred the following costs: *The equipment was purchased for $150,000 and has a current book value of $120,000, remaining useful life of four years, and a zero salvage value. If the company does not use the equipment, it can be leased for $8,000 per year.**Includes supervisors' salaries and rent for manufacturing plant. Required:The division is considering replacing the equipment used to manufacture its ceramic pots. Replacement equipment can be purchased at a price of

*The equipment was purchased for $150,000 and has a current book value of $120,000, remaining useful life of four years, and a zero salvage value. If the company does not use the equipment, it can be leased for $8,000 per year.**Includes supervisors' salaries and rent for manufacturing plant. Required:The division is considering replacing the equipment used to manufacture its ceramic pots. Replacement equipment can be purchased at a price of

$200,000. The new equipment, which is expected to last 4 years and have a salvage value of $20,000, will reduce unit-level labor costs by 25 percent. Assuming the division desires to maintain its production and sales at 10,000 ceramic pots per year, prepare a schedule that shows the relevant cost of operating the existing equipment versus the cost of operating the new equipment. Should the existing equipment be replaced? Why or why not? What will be an ideal response?

Product cost are also called inventoriable cost

Indicate whether the statement is true or false

A market-oriented organization recognizes that different customer groups want different features or benefits

Indicate whether the statement is true or false a. True b. False

Employers are legally required to treat pregnancy the same way they treat any other medical disability.

Answer the following statement true (T) or false (F)