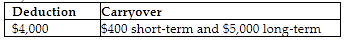

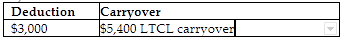

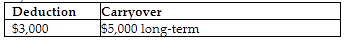

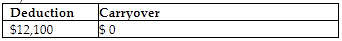

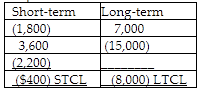

What is the amount of her capital loss deduction for the current year, and what is the amount and character of her capital loss carryover?

During the current year, Nancy had the following transactions:

A)

B)

C)

D)

B)

$3,000 is deductible currently—$400 of the STCL plus $2,600 of the LTCL. The remaining $5,400 of LTCL is carried over.

You might also like to view...

The system of preparing financial statements based on recognizing revenues when the cash is received and reporting expenses when the cash is paid is called:

A. Accrual basis accounting. B. Revenue recognition accounting. C. Cash basis accounting. D. Operating cycle accounting. E. Current basis accounting.

A salesperson knows that a prospect's desire for a product is solidified when the potential buyer asks a question about price.

Answer the following statement true (T) or false (F)

When a written contract does not correctly state the agreement already made but the parties either party make seek a(n):

A) rescission B) injunction C) reformation of the contract D) action for specific performance

A supermarket sells a complete selection of food and general merchandise at a steep discount in a single enormous location.

Answer the following statement true (T) or false (F)