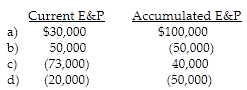

Green Corporation is a calendar-year taxpayer. All of the stock is owned by Evan. His basis for the stock is $35,000. On March 1 (of a non-leap year), Green Corporation distributes $120,000 to Evan. Determine the tax consequences of the cash distribution to Evan in each of the following independent situations:

a) $120,000 is a dividend to Evan.

b) $50,000 is dividend. $35,000 is a return of capital, which reduces Evan's basis to zero. The remaining $35,000 is taxable as a capital gain.

c) Green's accumulated E&P as of March 1 is $28,200 {$40,000 - [$73,000 × (59/365)]}. Therefore, $28,200 is taxable as a dividend. $35,000 is a return of capital and the remaining $56,800 is taxable as a capital gain.

d) $35,000 is a return of capital, which reduces Evan's basis to zero, and the remaining $85,000 is a capital gain.

You might also like to view...

A corporate income statement does not contain

a. discontinued operations. b. extraordinary gains and losses. c. unrealized investment gains and losses. d. earnings per share data.

To avoid legal problems, an interviewer should not ask if you are married

Indicate whether the statement is true or false

What information should you provide your references so that they can write a recommendation?

A) ?Name of the company B) ?Position title and expected job requirements C) ?A copy of your résumé D) ?You should provide all this information to your references.

What is a waiting line model, and what information can it provide?

What will be an ideal response?