Which of the following is considered an accelerated depreciation method?

A. Double-declining balance

B. MACRS

C. Units-of-production

D. Both double-declining-balance and MACRS

Answer: D

You might also like to view...

The operating cycle for all businesses is one year

a. True b. False Indicate whether the statement is true or false

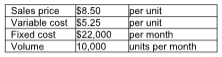

company believes that the volume will go up to 12,000 units if the company reduces its sales price to $7.50. How would this change affect operating income?

A small business produces a single product and reports the following data:

A) It will increase by $5500.

B) It will increase by $10,500.

C) It will decrease by $5500.

D) It will decrease by $10,500.

The Assembly Department of GigaGo, Inc., manufacturer of computers, had 4500 units of beginning inventory in September, and 3000 units were transferred to it by the Production Department. The Assembly Department completed 1500 units during the month and transferred them to the Packaging Department. Calculate the total number of units accounted for by the Assembly Department if it had 6000 units in ending inventory. The weighted-average method is used.

A) 6000 units B) 3000 units C) 4500 units D) 7500 units

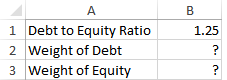

What are the correct formulas for cells B2 and B3?

a) =B1/(1-B1) and =1/(1-B1)

b) =B1/(1+B1) and =1/(1+B1)

c) =B1/(1+B1)^2 and =1/(1+B1)^2

d) =B1/(1-B1)^2 and =1/(1-B1)^2

e) =B1/(B1-1) and =1/(B1-1)