If reserves pay interest below the market federal funds rate, why would a bank hold any excess reserves?

What will be an ideal response?

There can be an opportunity cost to not having them. For example, if customer liquidity (cash) demands are higher than expected a bank would face the cost of having to quickly become liquid. That could mean selling securities or other assets or borrowing to meet those needs. Another possibility involves uncertainty regarding interest rates. If a banker believes interest rates may rise in the near future, it may be profitable to hold reserves rather than to purchase assets at a lower interest rate than what could have been obtained by waiting.

You might also like to view...

If the government faced a balanced budget rule, it would be forced to raise taxes or decrease spending during a recession

a. True b. False Indicate whether the statement is true or false

Which of the following constitutional provisions would help promote economic growth and prosperity?

A) the right of individuals and businesses to compete in markets B) protection of private property rights C) the right of citizens to freely engage in exchange with foreigners D) all of the above

Which of the following is included in the aggregate demand for goods and services?

a. consumption demand

b. investment demand

c. net exports

d. All of the above are correct.

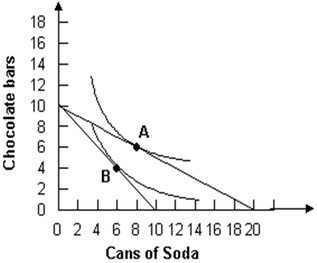

Refer to the graph shown. The diagram demonstrates that an increase in the price of soda will:

The diagram demonstrates that an increase in the price of soda will:

A. raise the quantity demanded of chocolate bars. B. reduce the quantity demanded of soda. C. raise the quantity demanded of soda. D. raise the consumer's available income.