What are the cash flows patterns related to bonds?

ACCOUNTING FOR BONDS

Firms typically issue bonds on the market to large numbers of debt investors to obtain cash for long-term purposes. The provisions of bond issues vary widely, depending on the firm's cash needs over time and the preferences of investors in the bonds. Investment bankers often advise corporate borrowers on the sorts of financial instruments the lending market appears to prefer at the time the firm wants to borrow.

The bond contract specifies the basis for computing all future cash flows for that bond issue. Identifying those cash flows is the starting point to account for the bond both initially and at each subsequent measurement date.

CASH FLOW PATTERNS FOR BONDS

Bonds vary with respect to the pattern of cash payments made by the borrower to debt investors. Three common types of bonds are coupon bonds, serial bonds, and zero coupon bonds.

The term face value refers to the principal amount printed on the face of the bond certificate. The principal or face value is the base for computing the amount of each semiannual coupon payment. At one time the bond certificate would have coupons attached, with each coupon equal to a percent of the principal amount and each dated, with dates six months apart. Investors would clip the predated coupons from the bond certificate each six months and deposit them in their bank accounts, just as they would deposit a check they had received. Although checks or electronic funds transfers have replaced coupons, the term coupon remains in use.

Serial bonds have a bond indenture requires that each periodic payment includes interest plus repayment of a portion of the principal.

Zero coupon bonds do not require periodic payments of interest. Instead the maturity value includes both principal and interest. Although these bonds do not state an interest rate, there is an implicit interest rate embedded in the maturity value.

You might also like to view...

A preview

a. tells your audience what to think. b. lets the audience know your speech’s subject and purpose. c. introduces your sources. d. identifies the evidence included in the body of your speech.

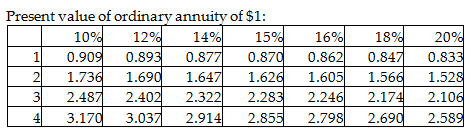

A company is considering an iron ore extraction project that requires an initial investment of $1,400,000 and will yield annual cash inflows of $613,228 for three years. The company's discount rate is 9%. Calculate IRR.

A) 15%

B) 17%

C) 14%

D) 13%

Examples of state limited-jurisdiction trial courts include:

A) Traffic courts. B) Juvenile courts. C) Family-law courts. D) All of the above

Rachel Finnegan is a broker who specializes in selling small homes. She has a listing for a small home with a list price of $90,000. When a prospective buyer comes through the house, he tells Rachel he is interested but the $90,000 is too high of a price. Rachel tells him, "Look, these people are desperate. They need to move, like tomorrow. They'll take whatever you offer." Rachel: A) Is just

acting as a dual agent. B) Cannot control offers and has done nothing wrong. C) Has breached her fiduciary duty to her client sellers with this disclosure. D) None of the above