An organization that is dedicated to assisting, both financially and through providing managerial support to small firms owned and operated by minority group members, is a:

a. SBDO

b. SBA

c. SIC

d. MESBIC

e. MOSBA

d. MESBIC

You might also like to view...

In the traditional strategic planning approach

A. interaction with important customers and suppliers was included. B. governments and other stakeholder activities were direct participants. C. strategic planning avoided collective mind-sets about the competitive environment. D. the CEO and the head of planning got together to devise a corporate plan, which would then be handed to the operating people for execution. E. there was strong and effective responsiveness to differences that occurred in local markets.

A company purchased equipment and signed a 7-year installment loan at 9% annual interest. The annual payments equal $9,000. The present value for an annuity (series of payments) at 9% for 7 years is 5.0330. The present value of 1 (single sum) for 7 years at 9% is 0.5470. The present value of the loan is:

A. $4,923. B. $63,000. C. $45,297. D. $9,000. E. $16,453.

Julie joined a meeting of colleagues in her new department. Though she had never been in a meeting in her new department, she used her extensive experience with meetings from her previous department to guide her behavior. In other words, Julie relied on a (n) ______ to guide her behavior in the new situation.

A. societal sanction B. internalization C. script D. work group interaction

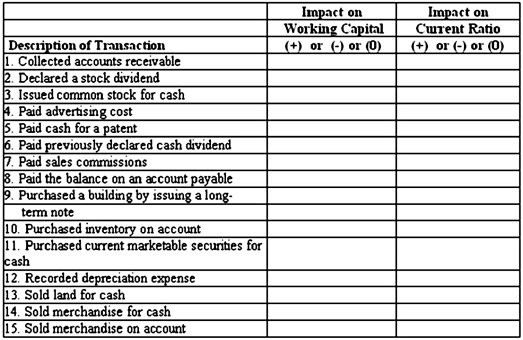

Many companies have to monitor some of their financial statement ratios, such as the current ratio, due to debt covenants. Selected transactions are provided below for a company that uses a perpetual inventory system; sells its merchandise at a selling price that exceeds cost; and had a current ratio of 1.85 to 1 before the event occurred. Required:In the above table, indicate whether each transaction would increase (+), decrease (?), or not affect (0) the company's working capital and the current ratio.

Required:In the above table, indicate whether each transaction would increase (+), decrease (?), or not affect (0) the company's working capital and the current ratio.

What will be an ideal response?