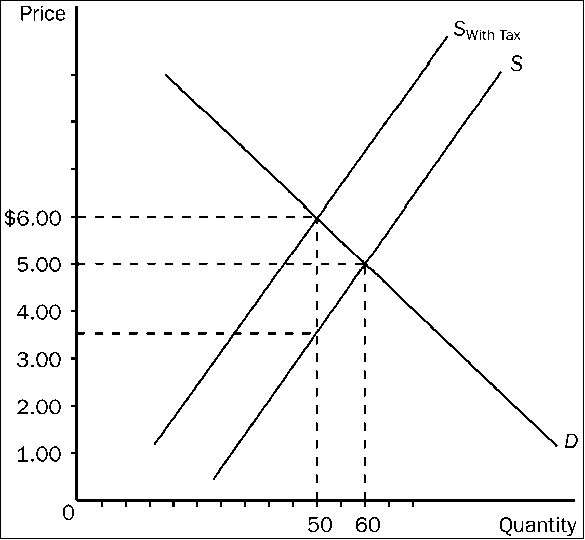

Figure 4-22

Refer to . The equilibrium price in the market before the tax is imposed is

a.

$1.00.

b.

$3.50.

c.

$5.00.

d.

$6.00.

c

You might also like to view...

When there is a recessionary gap, inflation will ________, in response to which the Federal Reserve will ________ real interest rates, and output will ________.

A. decline; lower; decline B. increase; raise; decline C. decline; lower; expand D. decline; raise; decline

Just as indifference maps represent consumer tastes, so isoquant maps represent a producer tastes.

Answer the following statement true (T) or false (F)

Real investment tends to be

A) procyclical and less variable than real GDP. B) procyclical and more variable than real GDP. C) countercyclical and less variable than real GDP. D) countercyclical and more variable than real GDP.

Answer the following statement(s) true (T) or false (F)

1. Small, medium, and large taxes all affect deadweight loss equally. 2. A large increase in tax can reduce the quantity exchanged to the point where there is very little tax revenue raised. 3. Subsidies create welfare gains. 4. Price ceilings create deadweight losses. 5. Deficiency payment programs are designed to help poor teachers.