Answer the following statement(s) true (T) or false (F)

1. There was no such thing as planned giving before the Tax Reform Act of 1969.

2. The federal estate tax affects only relatively wealthy people.

3. Deferred gifts benefit the organization only at some future time.

4. In 2013, donor-advised funds held more total assets than the Bill and Melinda Gates Foundation.

5. An “expectancy” is a promise that can be changed.

1. False

2. True

3. True

4. True

5. True

You might also like to view...

The Americans with Disabilities Act requires employers to

A. hire all qualified persons with disabilities who apply. B. actively solicit job applications from persons with disabilities. C. hire quotas of qualified persons with disabilities. D. reasonably accommodate an individual's disability. E. hire persons with disabilities to qualify for tax breaks.

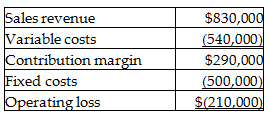

The company's management is considering dropping the western territory and has determined that 90% of the fixed costs are avoidable. What is the change in the forecasted operating loss for the upcoming year if the western territory is dropped? Assume the company predicts an operating loss across the entire company.

Geo Company's western territory's forecasted income statement for the upcoming year is as follows:

A) The loss will be reduced by $160,000.

B) The loss will be increased by $160,000.

C) The loss will be reduced by $450,000.

D) The loss will be increased by $450,000.

The local health-food store knows that many people might be interested in its products but has decided to aim all of its marketing activities at females under the age of 35. This store is utilizing the:

a. total market approach b. marketing concept c. multisegment approach d. market niche approach e. concentration approach

Empirical studies indicate that MNEs have higher costs of capital than purely domestic firms. This could be due to higher levels of:

A) political risk. B) exchange rate risk. C) agency costs. D) all of the above