Double taxation refers to a corporation's income being taxed twice-first when the company pays corporate income taxes on income it earns, and then again when stockholders pay personal income taxes when the company distributes that income as dividends to them.

Answer the following statement true (T) or false (F)

True

You might also like to view...

A balance of ______ and ______ lead to a clear definition of each individual’s responsibilities.

a. command; direction b. division of labor; flexibility c. responsibility; authority d. authority; direction

When preparing a tax return for a short period, the taxpayer should annualize the income if the short period return

A. is the first return for a corporation created on June 1. B. is the last return for a decedent who died on June 15. C. is the last return for a partnership, which was terminated on October 12. D. None of the above situations require annualization of income for the short period return.

Differentiate between unattractive and attractive competitive environments using Porter's model of competitive environment, and give an example for each situation.

What will be an ideal response?

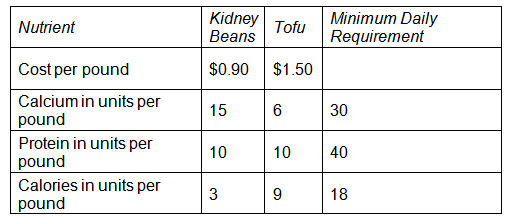

A school is trying to determine a nutritional diet to feed its students. The objective is to minimize cost, subject to meeting the minimum nutritional requirements of protein, calcium, and calories. The cost and nutritional content of each food, along with the minimum nutritional requirements, are shown here. Let K and T be the number pounds of kidney beans and tofu to be purchased. Which of the following is the optimal solution values of the decision variables?

a. K=1, T =3

b. K=3, T =1

c. K=2, T=2

d. K=4, T=1