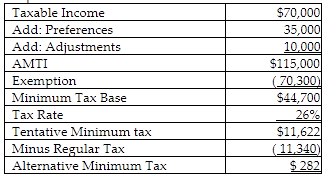

Lavonne, a single taxpayer, has a regular tax liability of $11,340 on taxable income of $70,000. She also has tax preferences of $35,000 and positive adjustments attributable to limitations on itemized deductions of $10,000. Lavonne's alternative minimum tax for 2018 is

A) $0.

B) $282.

C) $18,560.

D) None of the above.

B) $282.

You might also like to view...

All additions and some improvements increase the usefulness of buildings or equipment and will provide benefits in future periods

a. True b. False Indicate whether the statement is true or false

Critical media viewing is increased when you consider which of the following?

A) Who created this program? B) Is this program presented during prime time? C) How many people are watching this program? D) Is this program available in HD?

Auditing standards permit both statistical and nonstatistical methods of audit sampling.

Answer the following statement true (T) or false (F)

Mathis Inc is a home appliance manufacturing firm based in Vermont that sells its products under the brand name GoodHome. The firm initially built a reputation in the household appliances market for its high-quality products

After an extensive market research, the firm used its brand reputation to expand into the home furnishing industry. In this example, Mathis Inc uses which of the following product line extension strategies? A) a vertical brand-line extension strategy B) a horizontal brand-line extension strategy C) a new product-market brand extension strategy D) a cobranding extension strategy E) a product bundling extension strategy