An indexed equity mutual fund

a. is directly tied to either the consumer price index or the GDP deflator.

b. is a fund that hires a manager who will try to pick the stocks that will increase most in value in the future.

c. merely holds stocks in the same proportion as they exist in a broad stock market index like the Standard & Poor's 500.

d. will have high operating costs because these funds engage in a substantial amount of stock trading.

C

You might also like to view...

If the interest rate on borrowing falls,

a. the demand curve for loans will shift out. b. the discounted value now of money to be received in the future will fall. c. some previously unprofitable prospective investments will become profitable. d. All of the above are correct.

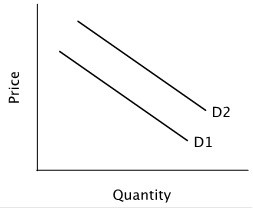

Refer to the figure below. Moving from demand curve D2 to demand curve D1 could be caused by a(n):

A. increase in the product's expected future price. B. increase in quantity supplied. C. increase in the price of a complement. D. increase in the price of a substitute.

An inferior good is one for which

A. demand increases as income increases. B. the demand curve is vertical. C. demand decreases as income increases. D. the demand curve slopes up.

The Keynesian short-run aggregate supply (SRAS) curve is

A. vertical. B. horizontal. C. downward sloping. D. upward sloping.