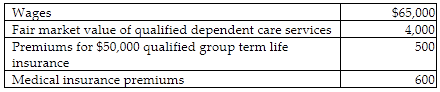

How much of this income should Carl report (assume benefits are provided on a nondiscriminatory basis)?

A) $65,000

B) $69,000

C) $69,500

D) $70,100

A) $65,000

Only the wages are taxable. Qualified dependent care services up to $5,000 are not taxable; premiums paid for group term insurance coverage up to $50,000 are not taxable; medical insurance premiums are not taxable.

You might also like to view...

Some have argued that the design of organizational arrangements should not be limited to questions of organizational structure, but should include all of the following, except:

a. Loosely designed sequence of steps. b. Operational methods. c. Applications that enable the performance of work. d. The formal patterns of relationships between groups and individuals.

Elaine is now a division manager, but for more than a decade she was the sales manager, and she tends to view all organizational problems based on the effect they will have on the sales department. Her decisions are flawed due to projection bias.

Answer the following statement true (T) or false (F)

The following income statement is provided for Vargas, Inc. Sales revenue (2,500 units × $60 per unit)$150,000 Cost of goods sold (variable; 2,500 units × $20 per unit) (50,000)Cost of goods sold (fixed) (8,000)Gross margin 92,000 Administrative salaries (42,000)Depreciation (10,000)Supplies (2,500 units × $4 per unit) (10,000)Net income$30,000 What is this company's magnitude of operating leverage?

A. 3.00 B. 1.67 C. 3.07 D. 0.33

The company for which Rosalinda works is changing from a vertical hierarchy to a horizontal organizational structure. Which of the following considerations should Rosalinda expect NOT to see in the new structure?

A) organization around cross-functional teams B) increased emphasis on multiple competencies C) increased emphasis on specialized expertise D) decreased emphasis on hierarchy E) decreased emphasis on teamwork