If Ron earns $50,000 in salary and pays income taxes of $15,000, and Harry earns $50,000 from investment dividends taxed at 20 percent, this would be

A. vertical inequity.

B. horizontal inequity.

C. vertical equity.

D. horizontal equity.

Answer: B

You might also like to view...

There is no good basis for dividing federal and state regulatory jurisdictions

Indicate whether the statement is true or false

Technical progress will:

a. shift a firm's production function and its related cost curves. b. not affect the production function, but may shift cost curves. c. shift a firm's production function and alter its marginal revenue curve. d. shift a firm's production function and cause more capital (and less labor) to be hired.

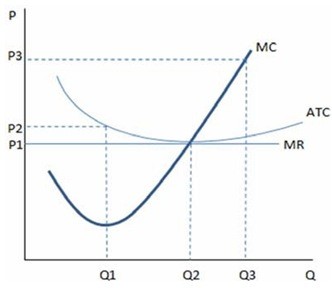

This graph represents the cost and revenue curves of a firm in a perfectly competitive market. According to the graph shown, if a firm is producing at Q2, and it is identical to others in the market:

According to the graph shown, if a firm is producing at Q2, and it is identical to others in the market:

A. firms will enter this market. B. economic profits are zero. C. firms will leave this market. D. profits are not being maximized.

An efficiency loss (or deadweight loss) declines in size when a unit of output is produced for which:

A. marginal cost exceeds marginal benefit. B. maximum willingness to pay exceeds minimum acceptable price. C. consumer surplus exceeds producer surplus. D. producer surplus exceeds consumer surplus.