The firm's cost of retained earnings is ________.

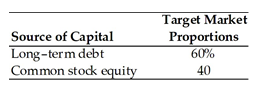

A firm has determined its optimal structure which is composed of the following sources and target market value proportions

Debt: The firm can sell a 15-year, $1,000 par value, 8 percent bond for $1,050. A flotation cost of 2 percent of the face value would be required in addition to the premium of $50.

Common Stock: A firm's common stock is currently selling for $75 per share. The dividend expected to be paid at the end of the coming year is $5. Its dividend payments have been growing at a constant rate for the last five years. Five years ago, the dividend was $3.10. It is expected that to sell, a new common stock issue must be underpriced $2 per share and the firm must pay $1 per share in flotation costs. Additionally, the firm has a marginal tax rate of 40 percent.

A) 10.2 percent

B) 14.3 percent

C) 18.9 percent

D) 15.0 percent

D) 15.0 percent

You might also like to view...

The concept behind ______________________________ is to cultivate customer relationships by prospecting, acquiring, servicing, and retaining customers

Fill in the blank(s) with correct word

Treetop Company paid off a $100,000 two-year note payable. The effect of this transaction is that the

a. earnings per share increased b. current ratio decreased c. debt-to-equity ratio increased d. debt-to-equity ratio decreased

The Norran Company needs 15,000 units of a certain part to use in its production cycle. If Norran buys the part from Waterloo Company instead of making it, Norran could not use the released facilities in another activity; thus, all of the fixed overhead applied will continue regardless of what decision is made. Accounting records provide the following data: Cost to Norran to make the part: Direct

materials, $3 Direct labor, $12 Variable overhead, $13 Fixed overhead applied, $8 Cost to buy the part from the Waterloo Company, $27 In deciding whether to make or buy the part, Norran's total relevant costs to make the part are a. $360,000. b. $240,000. c. $420,000. d. $405,000.

An understated ending inventory will produce an overstated cost of goods sold

Indicate whether the statement is true or false