Answer the following statements true (T) or false (F)

1. Auditors are responsible for making reasonable accounting estimates on behalf of

management.

2. External auditors are required to report illegal acts to the appropriate governmental

agency within 30 days of finding them.

3. All errors and irregularities, including trivial ones, should be reported to the audit

committee.

4. A materiality standard does not exist for frauds.

1. FALSE

2. FALSE

3. FALSE

4. FALSE

You might also like to view...

In which of the following circumstances may the auditor issue the standard unqualified, unmodified audit report?

A) The auditor has not been able to audit a substantial portion of the balance sheet because of circumstances beyond anyone's control. B) The client disclosed a change in accounting principles with an immaterial effect on financial position and results of operations. C) The financial statements do not disclose a justified departure from generally accepted accounting principles. D) The financial statements do not disclose significant going concern issues.

How much (in Canadian Dollars) will RXN expect to receive from the bank when its forward contract is settled?

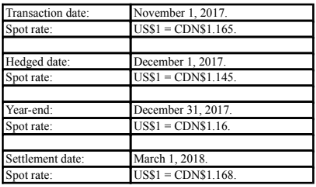

RXN's year-end is on December 31. On November 1, 2017 when the U.S. dollar was worth CDN$1.165, RXN sold merchandise to an American client for US$300,000. Full payment of this invoice was expected by March 1, 2018. On December 1, the spot rate was CDN$1.1450 and the three-month forward rate was CDN$1.1250.

In order to minimize its Foreign Exchange risk and exposure, RXN entered into a contract with its bank on December 1, 2017 to deliver US$300,000 in three months' time. The spot rate at year-end was CDN$1.16 and the forward rate from December 31, 2017 to March 1, 2018 was CDN$1.14. On March 1, 2018, RXN received

the US$300,000 from its client and settled its contract with the bank. The forward contract was to be accounted for as a fair value hedge of the US dollar receivable.

Significant dates and exchange rates pertaining to this transaction are as follows:

A) $337,500. B) $347,500. C) $349,500. D) $343,500.

SWOT stands for strengths, weaknesses, opportunities, and threats.

Answer the following statement true (T) or false (F)

Jenny always buys Stacy's brand pita chips. She does not even consider alternatives. Jenny is a ________ customer.

A. price-sensitive B. brand-association-oriented C. brand-persuasion-oriented D. brand-extension-oriented E. brand-loyal