What are the four explanations given as to why the Fed did not intervene to stabilize the banking system during the Great Depression?

What will be an ideal response?

First, no one was in charge. Second, the Fed was reluctant to rescue insolvent banks. Third, the Fed failed to recognize the difference between nominal and real interest rates. Fourth, the Fed wanted to purge speculative excess.

You might also like to view...

Leisure-Consumption indifference curves

a. slope upward and are concave. b. slope upward and are convex. c. slope downward and are concave. d. slope downward and are convex.

The growth rate of real GDP per capita is best captured by subtracting the percentage changes in:

A. both prices and population from the nominal GDP growth rate. B. population from the nominal GDP growth rate, while dividing it by the inflation rate in order to hold prices constant. C. population from the nominal GDP growth rate and not the percentage changes in prices. D. prices from the nominal GDP growth rate and not the population growth.

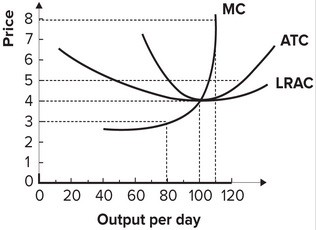

Refer to the graph shown, which depicts a perfectly competitive firm. If the price of the product is $3:

A. the firm may continue to operate in the short run but will exit the industry in the long run. B. the industry will be in long-run equilibrium. C. new firms will enter the industry. D. the firm will just cover its opportunity cost of production.

Property owned by everyone is generally referred to as

A. natural property. B. free property. C. common property. D. social property.