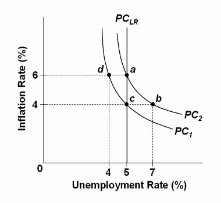

Refer to the diagram. Assume that the natural rate of unemployment is 5 percent and that the economy is initially operating at point a, where the expected and actual rates of inflation are each 6 percent. In the long run, the decline in the actual rate of inflation from 6 percent to 4 percent will:

A. reduce the unemployment rate.

B. reduce corporate profits in real terms.

C. have no effect on the unemployment rate.

D. reduce real domestic output.

C. have no effect on the unemployment rate.

You might also like to view...

The substitution effect of a real wage increase is observed when

A) the higher wage causes workers to take more leisure and work more hours. B) the higher wage causes workers to take more leisure and work fewer hours. C) leisure's higher opportunity cost causes workers to take less leisure and work more hours. D) leisure's higher opportunity cost causes workers to take more leisure and work fewer hours.

Countries should specialize and import goods in which they have a comparative disadvantage

a. True b. False Indicate whether the statement is true or false

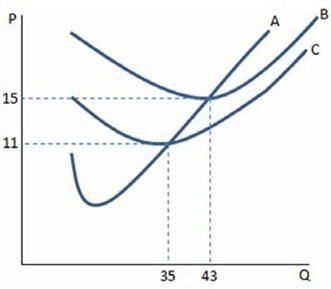

Of the curves displayed in the graph shown, graph B is most like to be the:

Of the curves displayed in the graph shown, graph B is most like to be the:

A. ATC curve. B. AFC curve C. AVC curve D. MC curve

In the open-economy macroeconomic model, the market for loanable funds equates national saving with

a. domestic investment. b. net capital outflow. c. the sum of national consumption and government spending. d. the sum of domestic investment and net capital outflow.