Thornton, Inc. has budgeted sales for the months of September and October at $303,000 and $289,000, respectively. Monthly sales are 80% credit and 20% cash. Of the credit sales, 50% are collected in the month of sale, and 50% are collected in the following month. Calculate cash collections for the month of October.

A) $173,400

B) $297,400

C) $294,600

D) $181,800

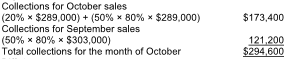

C) $294,600

Calculations of collections for the month of October:

You might also like to view...

If a project has an expected completion time of 15 weeks with a variance of 4 weeks, the probability that the project will be completed in 12 weeks is ______.

A. about 6.7% B. about 43.3% C. about 29.1% D. about 54.3%

Why does the employer fill out an IRS form 940 every year?

a. to report income taxes withheld from employee wages b. to report federal unemployment tax c. to report the number of employees from their company who have filed for unemployment d. to report the number of employees who filed a workers’ compensation claim

If a person believes that he or she has been discriminated against in the workplace, he or she cannot immediately file a lawsuit against the employer.

Answer the following statement true (T) or false (F)

The table shows financial data for Purrfect Pets, Inc. as of June 30, Year 3. Accounts Receivable$420,100? Retained Earnings 118,800? Inventories 58,490? Other Assets 69,490? Accounts Payable 350,100? Equipment 119,400? Cash 733,500? Common Stock 663,000? Notes Payable 269,080? Required: Prepare a balance sheet using these data.PURRFECT PETS, INC.Balance SheetJune 30, Year 3 ??????????????? ????????? ???????????

What will be an ideal response?