If the Federal Reserve wants to reduce inflation from 4 percent to 3 percent permanently, how can that goal be achieved, and what impact will that have on employment in the short run and the long run? Support your answer with a graph of the Phillips

curve in the short run and the long run.

If the Fed wants to reduce inflation, it must implement a contractionary monetary policy and make it credible. The reduction in the growth rate of the money supply will increase interest rates, reduce aggregate demand, and reduce real GDP and employment in the short run. In terms of the short-run Phillips curve, the economy will move from a point like A (high inflation and low unemployment) to a point like B (lower inflation and higher unemployment). Once firms and workers believe the Fed will continue to follow a contractionary monetary policy, they will begin to reduce their inflation expectations, and the short-run Phillips curve will shift downward. Equilibrium in the economy will be restored at the natural rate of unemployment but at a lower rate of inflation (move from point B on the short-run Phillips curve to point C on the long-run Phillips curve).

You might also like to view...

The population of Potentia doubled within 20 years while its income per capita remained unchanged during the same period of time. This implies that ________

A) its price level doubled B) its gross domestic product also doubled C) its price level halved D) its gross domestic product remained constant

When Americans increase their demand for Japanese goods

A) the demand for dollars will rise, and the demand for yen will rise. B) the supply of dollars will rise, and the demand for yen will rise. C) the demand for dollars will fall, and the demand for yen will rise. D) the supply of dollars will fall, and the demand for yen will fall.

The income elasticity for most staple foods, such as wheat, is known to be between zero and one

a. As incomes rise over time, what will happen to the demand for wheat? b. What will happen to the quantity of wheat purchased by consumers? c. What will happen to the percentage of their budgets that consumers spend on wheat? d. All other things equal, are farmers likely to be relatively better off or relatively worse off in periods of rising incomes?

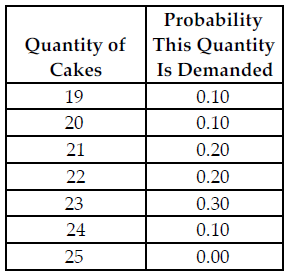

Refer to the table below. Busy Betty sells her cakes for $20 each and her constant marginal cost to produce each cake is $12, which is equal to her (constant) average total cost. If she does not sell a cake the day she makes it, she sells it as day-old cake for $10. What is her expected marginal cost of holding the 20th cake in inventory?

The above table shows the probability distribution of cake sales at Busy Betty's Bakery.

A) $0.40

B) $10.00

C) $0.20

D) $2.00