What is the term for a price index that measures average prices of all goods and services included in the economy?

a. Real value

b. Nominal value

c. GDP deflator

d. GDP inflator

c. GDP deflator

You might also like to view...

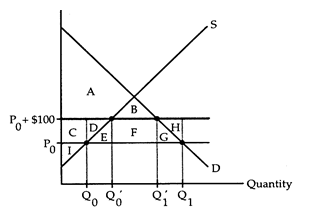

The accompanying diagram shows the U.S. market for automobiles. P0 is the world price of automobiles, Q0 is the quantity of American automobiles produced, and Q1 - Q0 is the quantity of automobiles imported. Consumers are indifferent between American and imported automobiles, but each imported automobile creates $100 of pollution costs.

(i) Calculate consumers' surplus, producers' surplus, the pollution damages, and social gain when no attempt is made to internalize the externality.

(ii) Suppose the government imposes a $100 tariff on imported automobiles. Calculate consumers' surplus, producers' surplus, tariff revenue, the pollution damages, and social gain in this situation. Did the tariff increase social gain? Did the tariff result in an efficient outcome? Explain.

Answer the following statement(s) true (T) or false (F)

1. If a model is based on unrealistic assumptions, then it cannot be robust. 2. Equilibrium conditions are used to analyze the desirability of economic outcomes. 3. A Nash equilibrium is one in which each individual optimizes taking market prices as given. 4. Efficiency is one common criterion that economists use to judge whether or not an outcome is desirable. 5. Even if an economic model is not detailed enough to give numerical predictions, it might still be useful if it can indicate the direction of change in economic variables.

Psychologists Daniel Kahneman and Amos Tversky conducted the following experiments by asking a sample of people the following questions:

Scenario A: "Imagine that you have decided to see a play and paid the admission price of $10 per ticket. As you enter the theater you discover that you have lost the ticket. The seat was not marked and the ticket cannot be recovered. Would you pay $10 for another ticket?" Scenario B: "Imagine that you have decided to see a play where admission is $10 per ticket. As you enter the theater you discover that you have lost a $10 bill. Would you still pay $10 for a ticket for the play?" As long as additional tickets are available, there's no meaningful difference between losing $10 in cash before buying a ticket, and losing the $10 ticket after buying it. In both cases, you are out $10. Yet, far more subjects (88 percent) in Scenario B say they would pay $10 for another ticket and see the play while in Scenario A, only 46 percent of the subjects say they would be willing to spend another $10 to see the play. Which of the following is the best explanation for the results of the experiment? A) The endowment effect applies in Scenario A since people already own the ticket and therefore it is more valuable but this is not so in Scenario B. B) In Scenario A, people make an immediate connection between the lost ticket and the play and feel poorer by incorrectly assigning a greater value to the value of the ticket whereas in Scenario B, they do not make the connection between the lost $10 bill and the play. C) In Scenario B, people had not anticipated spending an additional $10 so in effect the price of the ticket is $20 and not $10 whereas in Scenario A, the price of the ticket is still $10. D) The net benefit derived from watching the play is lower in Scenario A where the effective cost is $20 compared to the net benefit in Scenario B.

Market interest rates are determined by

a. banks b. Wall Street c. the demand for loanable funds d. the supply of loanable funds e. the demand for and supply of loanable funds