Suppose banks desire to hold no excess reserves and that the Fed has set a reserve requirement of 6 percent. If you deposit $8,000 into First Raven Bank,

a. First Raven's required reserves increase by $480.

b. First Raven will be able to lend out $7,520.

c. First Raven's assets and liabilities both will increase by $8,000.

d. All of the above are correct.

d

You might also like to view...

"Institutionalization" refers to the fact that a(n) __________ percentage of funds in the United States are flowing __________ the financial markets through financial intermediaries

A) increasing; indirectly into B) decreasing; indirectly into C) increasing; indirectly out of D) decreasing; directly out of

Commercial bank ownership of corporate stock is prohibited by regulators in

A) the United States. B) the United Kingdom. C) Germany. D) Japan.

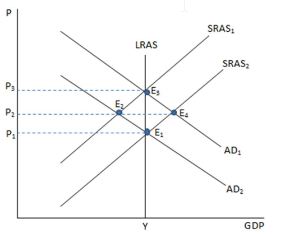

If the economy is represented in the graph shown and is currently at point E2, what could be said about the state of the economy?

A. There is higher unemployment than the natural rate.

B. There is lower unemployment than the natural rate.

C. The unemployment rate is just about the natural rate.

D. The unemployment rate is zero.

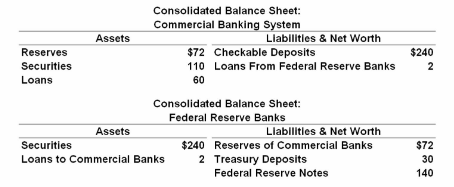

Refer to the given balance sheets. If the reserve ratio is 25 percent, commercial banks have excess reserves of:

A. $12.

B. $22.

C. $16.

D. $24.