Identity management is the integrated set of processes, services, and architectures that provide secure and appropriate access to organization system assets

Indicate whether the statement is true or false

T

You might also like to view...

The purpose of audit sampling is to draw inferences about the entire population from the results of a sample.

Answer the following statement true (T) or false (F)

Tie-in arrangements are considered to be a violation of the antitrust laws when the:

a. company insisting on the tie-in has monopoly power b. company insisting on the tie-in interferes with pre-existing contracts of the buyer c. buyer interferes with pre-existing contracts of the seller d. buyer is fully integrated vertically e. none of the other choices

Crimp Corporation uses the FIFO method in its process costing system. Department A had 10,000 units in process at the beginning of January that were 40% complete with respect to conversion costs. All materials are added at the beginning of the process in Department A. The January 1 work in process inventory in Department A contained $20,000 in materials cost and $11,000 in conversion cost. During January, materials costs were $2.00 per equivalent unit and conversion costs were $2.50 per equivalent unit. All of the units in the beginning work in process inventory were completed and transferred out during the month. What was the total cost attached to these units when they were transferred to the next department?

A. $26,000 B. $46,000 C. $35,000 D. $31,000

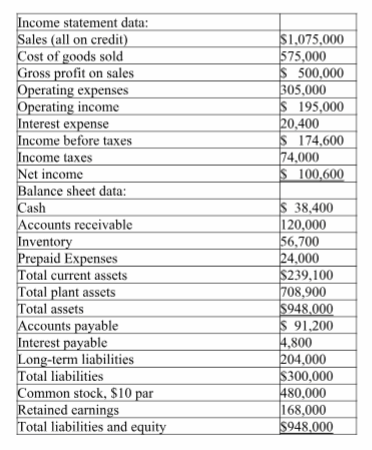

Use the following information from the current year financial statements of a company to calculate the ratios below:

(a) Current ratio.

(b) Accounts receivable turnover. (Assume the prior year's accounts receivable balance was $100,000.)

(c) Days sales uncollected.

(d) Inventory turnover. (Assume the prior years inventory was $50,200.)

(e) Times interest earned ratio.

(f) Return on common stockholders equity. (Assume the prior year's common stock balance was $480,000 and the retained earnings balance was $128,000.)

(g) Earnings per share (assuming the corporation has a simple capital structure, with only common stock outstanding).

(h) Price earnings ratio. (Assume the company's stock is selling for $26 per share.)

(i) Divided yield ratio. (Assume that the company paid $1.25 per share in cash dividends.)