Consider a market for fish whose market demand and market supply for fish are specified as Qd = 300 ? 2.5P and Qs = ? 20 + 1.5P, respectively. The government decides to impose a price ceiling of $50 per ton. What would be the resulting market distortion?

A. Surplus of 120 tons of fish

B. Surplus of 175 tons of fish

C. Shortage of 175 tons of fish

D. Shortage of 120 tons of fish

Answer: D

You might also like to view...

John Maynard Keynes created the aggregate expenditures model based primarily on what historical event?

A. economic expansion of the 1920s B. the Great Depression C. spectacular economic growth during World War II D. bank panic of 1907

If sellers compete against buyers, then

A) sellers would prefer to face more buyers in the market. B) sellers would prefer to face fewer buyers in the market. C) buyers would prefer to face fewer sellers in the market. D) buyers would prefer to face more sellers in the market. E) both B and C are true.

Modern hedge funds typically make investments that involve

A) hedging. B) speculating. C) acquiring safe, short-term assets. D) focus on stocks instead of bonds.

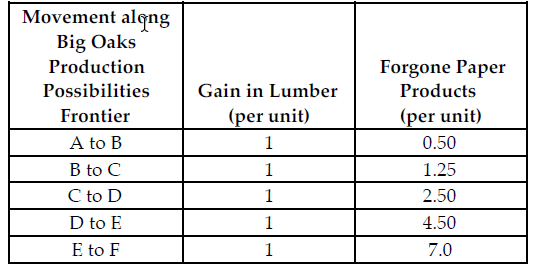

Refer to the table below. If the profit for each unit of paper product is $3.00 and the profit for each unit of lumber is $13.50, what is the marginal benefit for each unit of lumber produced?

Big Oaks can produce either paper products or lumber with each tree that they harvest. Because Big Oaks can adjust the amount of paper products and lumber they produce from the harvested trees, paper products and lumber are produced in variable proportions. The above table summarizes Big Oaks production possibilities from each harvested tree.

A) $13.50

B) $16.50

C) $10.50

D) $3.00