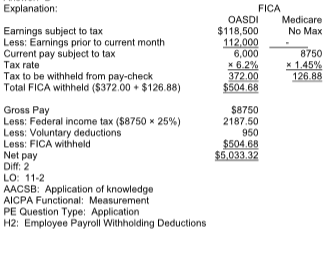

Sean's gross pay for this month is $8750. His gross year-to-date pay, prior to this month, totaled $112,000. Sean's rate for federal income tax is 25%. His voluntary deductions total $950. What is Sean's net pay? (Assume an OASDI rate of 6.2%, applicable on the first $118,500 earnings, and a Medicare rate of 1.45%, applicable on all earnings. Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.)

A) $6032.62

B) $5612.50

C) $6562.50

D) $5082.62

D) $5082.62

You might also like to view...

The main difference between intangible assets and property, plant, and equipment is the length of the asset's life

Indicate whether the statement is true or false

______________________________describe entities by capturing their essential characteristics.

Fill in the blank(s) with the appropriate word(s).

What is the role of cognition in forming attitudes to new technology?

What will be an ideal response?

Partners David and Goliath have decided to liquidate their business. The following information is available: Cash$100,000 Inventory 200,000 $300,000 Accounts payable$80,000 David, Capital 140,000 Goliath, Capital 80,000 $300,000 David and Goliath share profits and losses in a 3:1 ratio, respectively. During the first month of liquidation, half the inventory is sold for $70,000, and $50,000 of the accounts payable are paid. During the second month, the rest of the inventory is sold for $55,000, and the remaining accounts payable are paid. Cash is distributed at the end of each month, and the liquidation is completed at the end of the second month.Refer to the information provided above. Using a safe payment schedule, how much cash will be distributed to David at the end

of the first month? A. $42,500 B. $75,000 C. $22,500 D. $117,500