In questionnaire design, a question such as "Do anti-lock braking systems reduce car accidents?"

A. asks two questions at once.

B. steers respondents to a particular response.

C. is a question that respondents cannot easily or accurately answer.

D. is a question that respondents are reluctant to answer because the information is sensitive.

E. is one sided, presenting only one side of an issue.

Answer: C

You might also like to view...

To find the _____, the net present value of the system is calculated by combining the net present value of the costs of the system with the net present value of the benefits of the system.

A. rate of return (ROR) B. return on investment (ROI) C. return on assets (ROA) D. return on capital (ROC)

Answer the following statements true (T) or false (F)

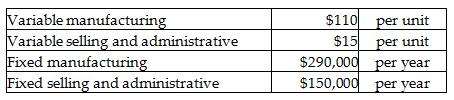

Seekers Company manufactures sonars for fishing boats. Model 70 sells for $250. Seekers produces and sells 5,600 of them per year. Cost data are as follows:

A potential deal has come up for a one-time sale of 30 units at a special price of $115 per unit. The marketing manager states that the sale will not negatively impact the company's regular sales activities and will require the normal variable manufacturing costs and selling and administrative costs. The production manager states that there is plenty of excess capacity and the deal will not impact fixed costs. The controller points out, however, that because the expected increase in revenues are equal to the expected increase in costs to fill the order, the deal will not have any impact on the bottom line. The controller is correct in his statement.

The dairy salesperson asked the store purchasing agent, "Do you think you'll need 10 or 12 pallets of ice cream for your 'Summer Buster' sales promotion?" This is an example of a(n):

A. indirect suggestion. B. counter offer. C. manipulative suggestion. D. autosuggestion. E. empathy suggestion.

In analyzing manufacturing overhead variances, the volume variance is the difference between the

a. amount shown in the flexible budget and the amount shown in the debit side of the overhead control account. b. predetermined overhead application rate and the flexible budget application rate times actual hours worked. c. budget allowance based on standard hours allowed for actual production for the period and the amount budgeted to be applied during the period. d. actual amount spent for overhead items during the period and the overhead amount applied to production during the period.