Tukey's multiple comparison method is based on the Studentized range statistic

Indicate whether the statement is true or false

T

You might also like to view...

Which of the following is/are the feature(s) of the income tax formula for individual taxpayers? I.This dichotomy of deductions results in an intermediate income number called adjusted gross income (AGI).II.One class of deductions is called exclusions from income.III.One class of deductions is called deductions for adjusted gross income.IV.Expenses qualifying as deductions for adjusted gross income are not limited by the income of the taxpayer.?

A. Statements III and IV are correct. B. Statements II and III are correct. C. Statements I, III, and IV are correct. D. Only statement IV is correct. E. Statements I, II, III, and IV are correct.

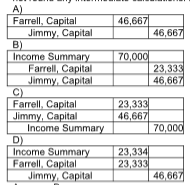

Farrell and Jimmy enter into a partnership agreement on May 1, 2018. Farrell contributes $60,000 and Jimmy contributes $120,000 as their capital contributions. They decide to share profits and losses in the ratio of their respective capital account balances. The net income for the year ended December 31, 2018 is $70,000. Which of the following is the correct journal entry to record the allocation of profit? (Do not round any intermediate calculations. Round your final answers to the nearest dollar.)

Which of the following statements is ethically questionable?

a. Effective communication should reflect personal values and company standards of ethical conduct. b. Managers should be certain to distinguish their opinions from facts. c. Unpleasant ideas should be stated as tactfully as possible to preserve self-esteem of the reader. d. Facts can be exaggerated as long as the purpose of the message reflects the reader's best interest.

Allison Engines Corporation has established a target capital structure of 40 percent debt and 60 percent common equity. The firm expects to earn $150,000 in after-tax income during the coming year, and it will retain 30 percent of those earnings. What is the break point of retained earnings?

A. $175,000 B. $75,000 C. $112,500 D. $500,000 E. $250,000