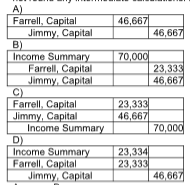

Farrell and Jimmy enter into a partnership agreement on May 1, 2018. Farrell contributes $60,000 and Jimmy contributes $120,000 as their capital contributions. They decide to share profits and losses in the ratio of their respective capital account balances. The net income for the year ended December 31, 2018 is $70,000. Which of the following is the correct journal entry to record the allocation of profit? (Do not round any intermediate calculations. Round your final answers to the nearest dollar.)

![]()

Explanation: Allocation based on capital balances uses the ratio of the partner's capital balance to the

total capital. In this case, Total Capital = $180,000 ($120,000 + $60,000)

Jimmy's Capital balance = $120,000

Income allocated to Jimmy = ($120,000 / $180,000) × $70,000 = $46,667

Farrell's Capital balance = $60,000

Income allocated to Farrell = ($60,000 / $180,000) × $70,000 = $23,333

You might also like to view...

A Type I error is committed when?

A. ?a true alternative hypothesis is not accepted. B. ?a true null hypothesis is rejected. C. ?the critical value is greater than the value of the test statistic. D. ?sample data contradict the null hypothesis.

Periodically, the Walt Disney Company recycles its oldest animated films, such as Snow White, back into movie theaters to delight a new generation of consumers

To what classification of the BCG growth-market share matrix would these old movies belong? Explain.

ITIL is described as ____.

A. a set of best practices for IT service management B. a discipline for managing IT services that focuses on the quality of those services C. the technology used to become best-in-class in an industry peer group D. the standard for software development used in the UK

Which of the following is a technique for measuring the impact of an advertisement during the final step of developing an advertising campaign?

A) pretesting B) attitudinal measures C) pulsing D) gross rating points (GRPs) E) cost per thousand (CPM)