An investor in a 30% marginal tax bracket, earning $10 in interest annually for a $100 U.S. Treasury bond:

A. earns a 10% after-tax return because interest on U.S. Treasury bonds is tax exempt at the federal level.

B. earns a 1% return after-tax.

C. would be indifferent between this bond and a municipal bond offering $7 annually per $100 of face value, assuming the same default risk and liquidity characteristics.

D. earns a 3% return after-tax.

Answer: C

You might also like to view...

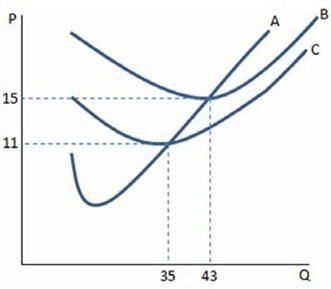

The figure above represents the demand and cost functions facing a Brazilian Steel producing monopolist. If it were unable to export, and was constrained by its domestic market, what quantity would it sell at what price?

What will be an ideal response?

In the long run the prices charged by a firm in monopolistic competition will be

a. high enough to provide profits to the firm. b. so low that many firms will drop out of the industry. c. equal to marginal cost. d. equal to average cost, including the opportunity cost of capital.

Of the curves displayed in the graph shown, graph B is most like to be the:

Of the curves displayed in the graph shown, graph B is most like to be the:

A. ATC curve. B. AFC curve C. AVC curve D. MC curve

A prerequisite of specialization is:

A. free enterprise. B. a capitalistic economic system. C. competition. D. a medium of exchange or money system.