What are the seven functions of the Federal Reserve System? Which one is most important?

What will be an ideal response?

The seven functions are: (1) issuing currency; (2) setting reserve requirements and holding required reserves of banks and thrift institutions; (3) lending money to banks and thrifts; (4) collecting and clearing checks for banks and thrifts; (5) serving as the fiscal agent for the U.S. government; (6) supervising the operation of member banks; and (7) controlling the money supply. Controlling the money supply to meet the needs of the economy is the most important function.

You might also like to view...

In trying to control the size of the money stock from day to day, the Fed relies principally on

A) adjustments in legal reserve requirements. B) changes in the central bank discount rate. C) purchases and sales of U.S. government bonds. D) the issue and withdrawal of currency from commercial banks.

Which of the following is NOT correct about the effects of a tariff on an imported product?

A) Tariffs benefit domestic producers by raising price and domestic output. B) Tariffs increase government revenue. C) Tariffs mean higher prices and less consumption for consumers of the product. D) Tariffs increase the efficiency of how resources are allocated.

A large government faces a production possibilities frontier much like a business firm does

a. True b. False Indicate whether the statement is true or false

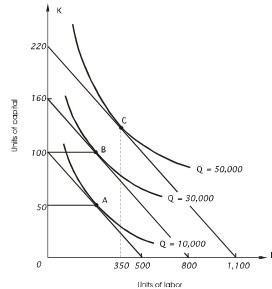

In the graph below, the price of capital is $500 per unit. When output is 10,000 units, what is long-run average cost?

A. $5 B. $500 C. $20 D. $0.20 E. none of the above