What is the potential annual interest rate savings if a firm is given the following terms to pay its account payable: 3/15, net/30?

What will be an ideal response?

[(% discount) / (100 – % discount)] × (365 / number of days paid early)

[(3) / (100 – 3)] × (365 / 15) = 75.26%

You might also like to view...

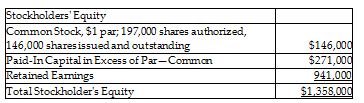

On June 30, 2018, Chris Brothers, Inc. showed the following data on the equity section of their balance sheet:

On July 1, 2018, the company declared and distributed a 8% stock dividend. The market value of the stock at that time was $17 per share. Following this transaction, what is the balance of Paid-In Capital in Excess of Par—Common?

A) $227,640

B) $523,160

C) $271,000

D) $457,880

U.S. GAAP and IFRS provide criteria for distinguishing operating leases from capital leases. Which of the following is not true?

a. Under the capital, or finance, lease method, the lessor records the signing of a capital lease the same as if the lessor sold the leased asset for an installment note receivable. b. Under the capital, or finance, lease method, the lessee recognizes interest expense on the lease liability, similar to recognizing interest expense on long-term notes or bonds. c. Under the capital, or finance, lease method, the lessee amortizes the leased asset, similar to recognizing depreciation on buildings and equipment. d. Under the capital, or finance, lease method, the lessor records the leased asset and the lease liability on the balance sheet at the present value of the contractual cash flows at the time of signing the lease. e. The capital, or finance, lease method, treats leases equivalent to installment purchases or sales, where the lessee borrows funds from the lessor to purchase the asset and the lessor recognizes profit at the time of sale.

Projections for future dollar value of a product are part of the initial screening.

Answer the following statement true (T) or false (F)

Discuss the various unions involved in the motion picture industry

What will be an ideal response?