Prices serve the public interest by

a. making resource owners wealthy.

b. rationing scarce resources.

c. keeping poor people from purchasing more than they can afford.

d. forcing the government to participate in the market.

b

You might also like to view...

Refer to Figure 8.2. Holding other variables constant, an increase in income taxes will result in a

A) movement from point A to point B. B) movement from point B to point A. C) shift from curve S1 to curve S2. D) shift from curve S2 to curve S1.

A production function will begin

A. at the origin. B. on the horizontal axis. C. on the vertical axis. D. in the middle of the diagram (at a positive L and positive output).

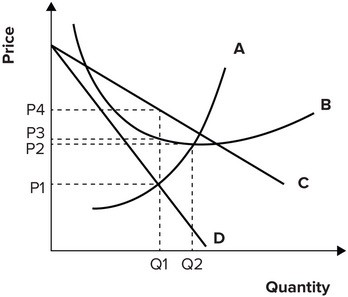

Refer to the graph shown. To maximize profit, the monopolistically competitive firm represented in this graph will produce:

A. Q1 and set price equal to P4. B. Q1 and set price equal to P3. C. Q2 and set price equal to P2. D. Q1 and set price equal to P1.

Which statement is true?

A. The federal personal income tax is a proportional tax. B. The cigarette tax is an excise tax. C. The tax on gasoline is a direct tax. D. None of these statements are true.