Find the amount of taxable income and the tax owed. The letter following the name indicates the marital status, and all married people are filing jointly. Use $3700 for each personal exemption; a standard deduction of $5800 for single people, $11,600 for married people filing jointly, $5800 for married people filing separately, and $8500 for head of a household; and the following tax rate schedule.

A. $81,590; $12,647.50

B. $95,621; $16,155.25

C. $92,690; $15,422.50

D. $84,521; $13,380.25

Answer: A

You might also like to view...

Expand the quotient by partial fractions.

A.  +

+

B.  +

+

C.  +

+

D.  +

+

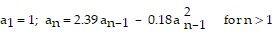

Solve the problem.Suppose that an insect population density, in thousands, during year n can be modeled by the recursively defined sequence:  .Use technology to graph the sequence for n = 1 , 2 , 3 , ........., 20 . Describe what happens to the population density function.

.Use technology to graph the sequence for n = 1 , 2 , 3 , ........., 20 . Describe what happens to the population density function.

A. The insect population stabilizes near 4.52 thousand. B. The insect population stabilizes near 7.72 thousand. C. The insect population stabilizes near 7.18 thousand. D. The insect population increases every year.

Determine the quarterly payment necessary to accumulate $65,000 in a fund paying 8% per year, compounded quarterly, for 10 years. Assume end-of-period deposits and compounding at the same intervals as deposits. Round the answer to the nearest cent. ?

A. $1,034.01 per quarter B. $1,038.64 per quarter C. $1,099.65 per quarter D. $1,133.47 per quarter E. $1,076.12 per quarter

Multiply. ?

?

A.

B.

C. 81xy2

D.