Use the following formula to answer the indicated question: Welfare benefit = Maximum benefit - 0.7 [Wages - (Work expenses + Child care costs)] Based on the information given, the marginal tax rate is

A. Zero percent.

B. 70 percent.

C. 30 percent.

D. 100 percent.

Answer: B

You might also like to view...

A decrease in the real wage would result in a

A) movement along the labor demand curve, causing an increase in the number of workers hired by the firm. B) shift of the labor demand curve, causing an increase in the number of workers hired by the firm. C) movement along the labor demand curve, causing a decrease in the number of workers hired by the firm. D) shift of the labor demand curve, causing a decrease in the number of workers hired by the firm.

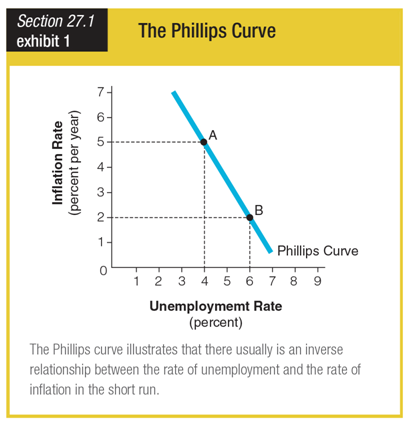

The graph for the Phillips curve shows an ______ relationship between the rate of unemployment and the rate of inflation.

a. independent

b. indeterminate

c. identical

d. inverse

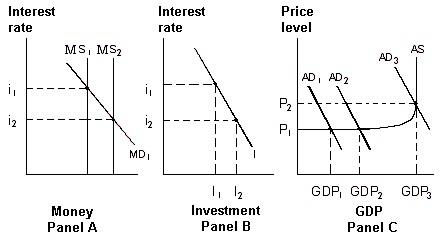

Exhibit 16-5 Money, investment and product markets

A. increase, and aggregate demand will shift from AD1 to AD2. B. decrease, and aggregate demand will shift from AD2 to AD1. C. remain the same, and aggregate demand will shift from AD2 to AD3. D. increase, and aggregate demand will shift from AD2 to AD1.

Which of the following is an implicit cost to a firm that produces a good or service?

A. Labor costs B. Foregone profits of producing a different good or service C. Costs of operating production machinery D. Costs of renting or buying land for a production site