Name two ways the equity in your home can increase.

What will be an ideal response?

Home equity can increase as you pay off your mortgage and as the value of your property increases.

You might also like to view...

The use of a firm's total retail strategy to satisfy its target market represents the coordinated effort phase of the retailing concept

Indicate whether the statement is true or false

A company uses the following standard costs to produce a single unit of output. Direct materials6 pounds at $0.90 per pound=$5.40 Direct labor0.5 hour at $12.00 per hour=$6.00 Manufacturing overhead0.5 hour at $4.80 per hour=$2.40 During the latest month, the company purchased and used 58,000 pounds of direct materials at a price of $1.00 per pound to produce 10,000 units of output. Direct labor costs for the month totaled $56,350 based on 4,900 direct labor hours worked. Variable manufacturing overhead costs incurred totaled $15,000 and fixed manufacturing overhead incurred was $10,400. Based on this information, the total direct labor cost variance for the month was:

A. $1,200 unfavorable B. $2,450 unfavorable C. $1,200 favorable D. $3,650 favorable E. $2,450 favorable

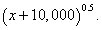

Suppose that a decision maker's risk attitude toward monetary gains or losses x given by the utility function U(x) =

What will be an ideal response?

Will an arbitrageur facing the following prices be able to make money? Borrowing Lending Bid Ask$5% 4.5% Spot$1.00 = €1.00 $1.01 = €1.00€6% 5.5% Forward$0.99 = €1.00 $1.00 = €1.00

A. Yes, borrow €1,000 at 6 percent; trade for $ at the bid spot rate $1.00 = €1.00; invest $1,000 at 4.5 percent; hedge this with a forward contract on €1,045 at $1.00 = €1.00. B. No; the transactions costs are too high. C. Yes, borrow $1,000 at 5 percent; trade for € at the ask spot rate $1.01 = €1.00; Invest €990.10 at 5.5 percent; hedge this with a forward contract on €1,044.55 at $0.99 = €1.00; receive $1.034.11. D. none of the options