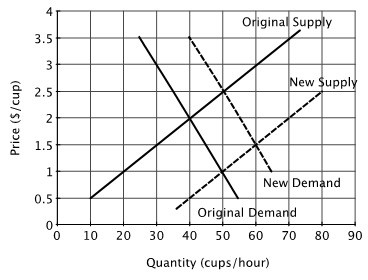

Refer to the accompanying figure, which shows the market for cups of coffee. Consider the original supply and the original demand curve. If the government imposes a price ceiling of $1.00 on a cup of coffee, then there would be:

A. a short-term excess demand for coffee, followed by an increase in the equilibrium price.

B. an excess demand for coffee.

C. a new equilibrium at a price of $1.00 per cup and a quantity of 50 cups per hour.

D. an excess supply of coffee.

Answer: B

You might also like to view...

The capture theory of regulation is defined as

A) the use of regulations to assure the efficient use of resources. B) the constant reapplication of regulation on the cable TV industry. C) the use of regulation to assist producers to maximize profits. D) the removal of regulations on business activities. E) regulation that focuses on consumers' interests and ignores producers' interests.

The government prefers an ad valorem tax to a specific tax that reduces the monopoly output by the same amount because

A) consumers are not harmed by the ad valorem tax. B) the monopoly prefers the ad valorem tax. C) consumers prefer the ad valorem tax. D) the ad valorem tax transfers more revenue from the monopoly to the government.

Which of the following best illustrates the difference between GDP and GNP?

a. GDP measures the goods consumed by the citizens of a country, while GNP measures output exported to other countries. b. GDP measures the output produced by the citizens within a country, while GNP measures output produced by noncitizens within a country. c. GDP measures the output produced by the citizens of a country, while GNP measures output produced within the borders of a country. d. GDP measures the output produced within the borders of a country, while GNP measures output produced by the citizens of a country.

Suppose the demand for macaroni is inelastic, the supply of macaroni is elastic, the demand for cigarettes is inelastic, and the supply of cigarettes is elastic. If a tax were levied on the sellers of both of these commodities, we would expect that the burden of

a. both taxes would fall more heavily on the buyers than on the sellers. b. the macaroni tax would fall more heavily on the sellers than on the buyers, and the burden of the cigarette tax would fall more heavily on the buyers than on the sellers. c. the macaroni tax would fall more heavily on the buyers than on the sellers, and the burden of the cigarette tax would fall more heavily on the sellers than on the buyers. d. both taxes would fall more heavily on the sellers than on the buyers.