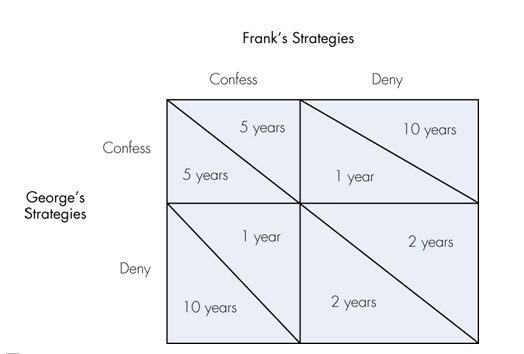

Refer to the table below for a prisoner’s dilemma. Frank and George are arrested and charged with armed robbery. They are isolated in separate interrogation rooms and therefore are not allowed to engage in collusion to collectively deny committing the crime. The table shows the four possible outcomes for denial and confession for Frank and George. The payoff to Frank is in the upper corner of each box, and the payoff to George is in the lower corner of each box. The most likely outcome is

a. for both to confess and spend 5 years in prison.

b. for both to deny and spend 2 years in prison.

c. for George to deny and spend 10 years in prison and Frank to confess and spend 1 year in prison.

d. for George to confess and spend 1 year in prison and Frank to deny and spend 10 years in prison.

a. for both to confess and spend 5 years in prison.

You might also like to view...

A monopoly is:

A. a seller of a highly advertised and differentiated product in a market with low barriers to entry in the long run. B. the only seller of a good for which there are no good substitutes in a market with high barriers to entry. C. the only buyer of a unique raw material. D. the producer of a product subsidized by the government.

The fundamental invention underpinning the recent productivity acceleration is the:

A. fuel cell. B. microchip. C. Internet. D. personal computer.

Frank purchases snickle-dees only because his friends do. This is a

A. dominant strategy B. negative-sum game. C. positive market feedback. D. negative market feedback.

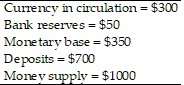

Consider an economy that has the following monetary data. The monetary base and the money supply are expected to grow at a constant rate of 20% per year. Inflation and expected inflation are 20% per year. Suppose that bank reserves and currency pay no interest, all currency is held by the public, and bank deposits pay no interest.(a)What is the cost to the public of the inflation tax?(b)What is the nominal value of seignorage over the year?(c)What is the profit to the banks from the inflation?

The monetary base and the money supply are expected to grow at a constant rate of 20% per year. Inflation and expected inflation are 20% per year. Suppose that bank reserves and currency pay no interest, all currency is held by the public, and bank deposits pay no interest.(a)What is the cost to the public of the inflation tax?(b)What is the nominal value of seignorage over the year?(c)What is the profit to the banks from the inflation?

What will be an ideal response?