Which of the following statements is CORRECT?

A. An investment that has a nominal rate of 6% with semiannual payments will have an effective rate that is smaller than 6%.

B. The present value of a 3-year, $150 ordinary annuity will exceed the present value of a 3-year, $150 annuity due.

C. If a loan has a nominal annual rate of 7%, then the effective rate will never be less than 7%.

D. If a loan or investment has annual payments, then the effective, periodic, and nominal rates of interest will all be different.

E. The proportion of the payment that goes toward interest on a fully amortized loan increases over time.

Answer: C

You might also like to view...

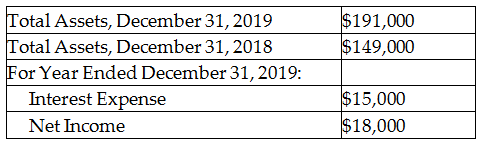

Based on the following information for Montana Investments, Inc., compute the rate of return on total assets. (Round the percentage to two decimal places.)

A) 9.42%

B) 19.41%

C) 9.71%

D) 1.76%

One of the purposes of the statement of cash flows is to ________.

A) determine the operating income of a business B) to calculate inventory turnover C) evaluate the level of debt and leverage of a company D) predict the ability of a company to pay debts and dividends

Techniques to elicit audience desire and overcome reader resistance in a marketing message include all of the following except

A) testimonials B) money-back guarantees. C) application forms. D) free samples or trials.

In the minimal-spanning tree technique, it is necessary to start at the last node in the network

Indicate whether the statement is true or false