Sarah buys little stuffed animals for $5 each. They come in different varieties. If the producer stops making (retires) a certain variety, a stuffed animal of that variety will be worth $100; otherwise it is worth $0

There is 25% chance that any variety will be retired. For the purchase of an individual animal, what is the value to Sarah of knowing ahead of time whether or not that variety will be retired?

If Sarah did not know whether a variety is to be retired, her expected value of a purchase is

(.75 ? -5 ) + (.25 ? 95 ) = -3.75 + 23.75 = $20.

If she knows ahead of time that a variety won't be retired, she won't buy one. So, her expected value becomes (.75 ? 0 ) + (.25 ? 95 ) = $23.75.

The information that a variety will or will not be retired is worth $3.75 to her.

You might also like to view...

The following table displays the marks obtained by three students on an economics test

Student Marks Obtained (out of 100) Mary 78 Charles 83 Tony 65 a) Calculate the mean marks obtained by the three students. b) Suppose one of the scores was reported incorrectly. Charles scored 38 instead of 83. How will the mean change if the correction is incorporated? c) How does the amount of data used affect the accuracy of a model?

Jack just told his boss that he thinks his boss is an idiot. It is likely that Jack will be experiencing ________ unemployment in the near future

A) cyclical B) structural C) frictional D) permanent

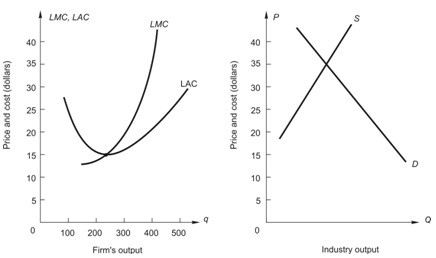

Below, the graph on the left shows long-run average and marginal cost for a typical firm in a perfectly competitive industry. The graph on the right shows demand and long-run supply for an increasing-cost industry. If this were a constant-cost industry, what would be the price when the industry gets to long-run competitive equilibrium?

If this were a constant-cost industry, what would be the price when the industry gets to long-run competitive equilibrium?

A. between $35 and $20 B. $20 C. above $35 D. $35 E. below $20

The rate at which two currencies can be traded for each other is called the ________ exchange rate.

A. real B. fixed C. nominal D. flexible