Critically evaluate the following statement. "Automobile manufacturers continue to produce cars that are dangerous

Therefore the industry should be considered as a market failure and safety mandates should be imposed by the government to insure that all cars are completely safe."

Safety is a good that people choose to purchase. Evidence of this is apparent around us. Some people choose to purchase more expensive cars that are safer than others. Typically these cars are produced with more safety features, are heavier and larger than other cars. Some people choose to purchase smaller cars for their fuel economy. By doing so they are implicitly choosing to "purchase" less safety. It is not necessarily a form of market failure if people are getting what they pay for.

You might also like to view...

How can corporate management defend itself against a hostile takeover attempt?

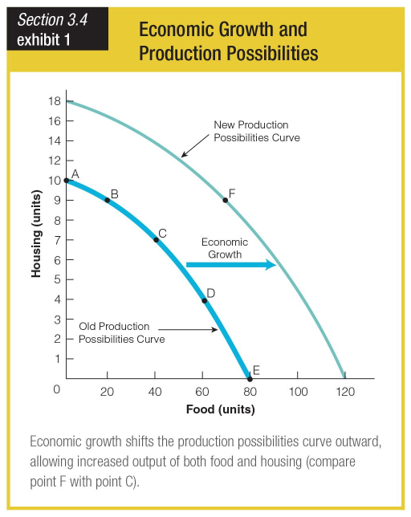

In this economic growth and production possibilities curve, how much more food can a country produce on the new curve compared to the old curve if it produces no housing on either one?

a. 7 units

b. 10 units

c. 40 units

d. 80 units

What are the consequences for a nation that keeps its exchange rate fixed, holds its own domestic interest rates below market to encourage domestic spending, and allows free foreign investment?

a. Foreign investors will not invest, so the only consequence will be a decline in the inflow of foreign investment. b. Domestic and foreign investors will invest in other nations, causing a sell-off of the domestic currency and, to maintain fixed rates, the central bank will have to buy its own currency, depleting its treasury reserves. c. There will be upward pressure on the rate of interest as more borrowing occurs, so the central bank will have to increase the stock of money. d. Interest rates in other nations will also fall as banks and other firms have to compete for international borrowers.

As the multiplier process works through time, the size of the multiplier effect becomes

A. larger. B. smaller. C. constant. D. explosive.