The amount of other expenses appearing on Big Guy's June 30, 2020 consolidated income statement would be:

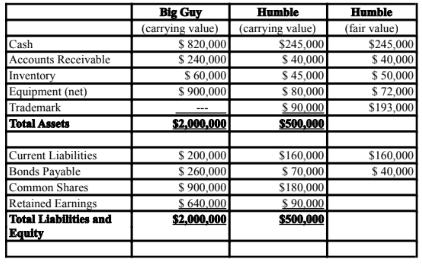

Big Guy Inc. purchased 80% of the outstanding voting shares of Humble Corp. for $360,000 on July 1, 2017. On that date, Humble Corp. had Common Shares and Retained Earnings worth $180,000 and $90,000, respectively. The Equipment had a remaining useful life of 5 years from the date of acquisition. Humble's Bonds mature on July 1, 2027. Both companies use straight line amortization, and no salvage value is assumed

for assets. The trademark is assumed to have an indefinite useful life.

Goodwill is tested annually for impairment. The balance sheets of both companies, as well as Humble's fair market values on the date of acquisition are disclosed below:

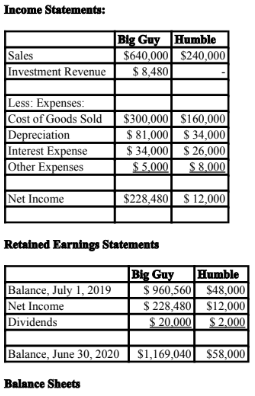

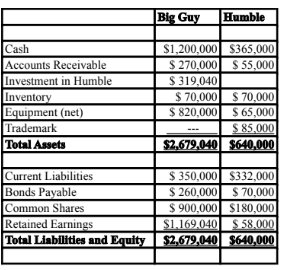

The following are the Financial Statements for both companies for the fiscal year ended June 30, 2020:

An impairment test conducted in September 2018 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded. Both companies use a FIFO system, and Humble's entire inventory on the date of acquisition was sold during the following year. During 2020, Humble Inc. borrowed $20,000 in cash from Big Guy Inc. interest free to finance its operations. Big Guy uses the Equity Method to account for its investment in

Humble Corp. Assume that the entity method applies.

A) $13,000. B) $11,600. C) $12,000. D) $13,400.

A) $13,000.

You might also like to view...

The data definition language

a. identifies, for the database management system, the names and relationships of all data elements, records, and files that comprise the database b. inserts database commands into application programs to enable standard programs to interact with and manipulate the database c. permits users to process data in the database without the need for conventional programs d. describes every data element in the database

Jublot Corporation uses the weighted-average method in its process costing system. Data concerning the first processing department for the most recent month are listed below: Beginning work in process inventory: Units in beginning work in process inventory 600 Materials costs$7,300 Conversion costs$2,300 Percent complete with respect to materials 50%Percent complete with respect to conversion 10%Units started into production during the month 9,400 Units transferred to the next department during the month 8,600 Materials costs added during the month$196,300 Conversion costs added during the month$315,800 Ending work in process inventory: Units in ending work in process inventory 1,400 Percent complete with respect to materials 70%Percent complete with

respect to conversion 40%The cost per equivalent unit for materials for the month in the first processing department is closest to: A. $14.48 B. $15.88 C. $21.25 D. $16.31

The purchase of stocks and bonds to obtain a return on the funds invested is known as __________.

Fill in the blank(s) with the appropriate word(s).

Full truckload shipping (FTL) involves transportation ______.

a. of homogeneous goods b. that is exemplified by FedEx or UPS c. that is particularly suitable for liquids (oils, liquid chemicals, etc.) d. that is highly regulated