Suppose the equilibrium price in the market is $10 and the price elasticity of demand for the linear demand function at the market equilibrium is ?1.25. Then we know that:

A. marginal revenue is $2.

B. demand is unit elastic.

C. marginal revenue is $50.

D. demand is inelastic.

Answer: A

You might also like to view...

Erik can work as a forest ranger, where the probability of being killed in a work-related accident is 1/6,000, or he can earn an additional $800 a year by working as a game warden,

where the probability of being killed in a work-related accident is 3/6,000. Using the compensating differential approach and the above information, what is the value of Erik's life? A) $1.6 million B) $2.4 million C) $3.2 million D) $4.8 million

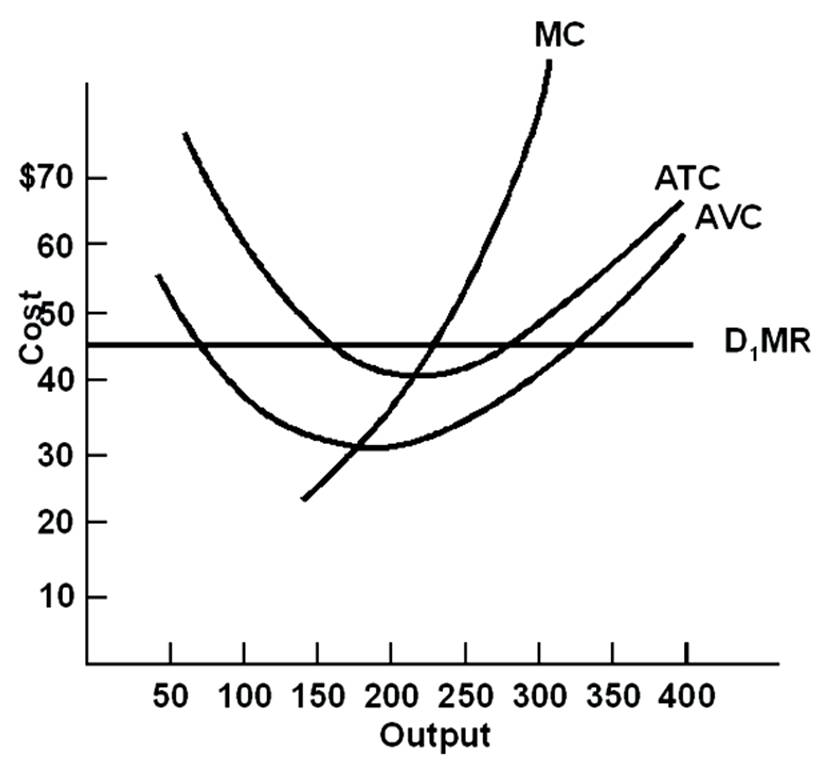

The firm's short-run supply curve begins at an output of

A. 100.

B. 175.

C. 250.

D. 300.

Table 1.2 shows the hypothetical trade-off between different combinations of Stealth bombers and B-1 bombers that might be produced in a year with the limited U.S. capacity, ceteris paribus.Table 1.2Production Possibilities for BombersCombinationNumber of B-1 BombersOpportunity cost(Foregone Stealth)Number of Stealth BombersOpportunity cost (Foregone B-1)A20NA195 B35 180 C45 150 D50 100NARefer to Table 1.2. In the production range of 20 to 35 B-1 bombers, the opportunity cost of producing 1 more B-1 bomber is

A. 15 Stealth bombers. B. 1 Stealth bomber. C. 195/20 of Stealth bombers. D. 35/20 of Stealth bombers.

If property rights are weak or uncertain, resource extraction will tend to:

A. occur faster than the rate that would maximize the long-run stream of profits. B. occur slower than the rate that would maximize the long-run stream of profits. C. occur at the rate that would maximize the long-run stream of profits. D. stop.