Which of the following statements is not correct?

a. All states have state income taxes, but the percentages vary widely.

b. Sales taxes and property taxes are important revenue sources for state and local governments.

c. Medicare spending has increased because the percentage of the population that is elderly and the cost of healthcare have both increased.

d. A budget deficit occurs when government spending exceeds government receipts.

a

You might also like to view...

The price of cereal rises. As a result, people have cereal for breakfast on fewer days and eat eggs instead. This behavior is an example of

A) a decrease in the quantity demanded of cereal because of the substitution effect. B) an increase in the quantity demanded of eggs because of the income effect. C) a decrease in the quantity supplied of cereal because of the substitution effect. D) an increase in the quantity supplied of eggs because of the income effect.

Contractionary monetary policy should be used if:

A) aggregate demand-aggregate supply equilibrium is below potential output. B) aggregate demand-aggregate supply equilibrium is above potential output. C) aggregate demand-aggregate supply equilibrium is equal to potential output. D) none of the above.

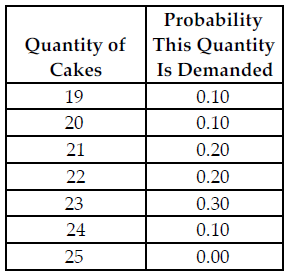

Refer to the table below. Busy Betty sells her cakes for $20 each and her constant marginal cost to produce each cake is $12, which is equal to her (constant) average total cost. What is her expected marginal benefit from holding the 20th cake in inventory?

The above table shows the probability distribution of cake sales at Busy Betty's Bakery.

A) $7.80

B) $8.00

C) $7.20

D) $12.80

Shirley can choose between peanut butter pretzels and caramel coated popcorn for her evening snack. According to economists, her _____ cost of consuming caramel coated popcorn would be the forgone peanut butter pretzels

a. internal b. opportunity c. average d. transaction e. social