Lora earns an income of $7,500 per month. Under the federal income tax system, the first $6,000 she earns is taxed at 10% and the remaining income is taxed at 20%. Then the average tax paid by Lora equals _____

a. 25 percent

b. 12 percent

c. 30 percent

d. 20 percent

b

You might also like to view...

If supply of a product increases and demand for the product decreases, equilibrium quantity will definitely change

Indicate whether the statement is true or false

If you purchased a newly issued 30-year bond from American Airlines with a face value of $1,000 and a coupon payment of 3 percent, American Airlines would pay you

A) $33.33 per year plus 3 percent per year for 30 years. B) $30 per year for 30 years. C) $30 per year for 30 years plus $1,000 at the end of the 30th year. D) $33.33 per year for 30 years plus $1,000 at the end of the 30th year.

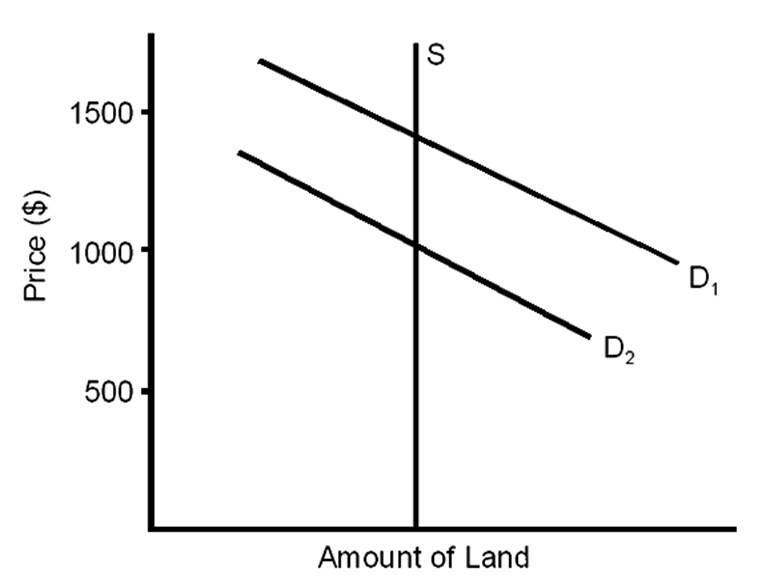

Rent, after the change in demand from D/1 to D/2, would be

A. $1,500.

B. $1,000.

C. $500.

D. impossible to determine with the information available.

Which of the following firms rely on patents the most as the barrier to keep other firms from entering the industry?

A. pharmaceutical firms B. textbook publishers C. law firms D. wine makers