How does the form that government spending takes affect resource allocation between public goods and private goods?

Government spending can take two forms: purchase of public and merit goods or transfer payments. If the

government buys public goods, it creates a reallocation of resources toward producing public goods and away from

private goods. If the government transfers income from taxpayers to other groups, this reallocation does not occur.

This is because the transfer recipients' purchases of private goods substitute for the taxpayers' purchases. We may,

however, see the transfer recipients buying different private goods than the taxpayers would have bought.

You might also like to view...

What is meant by utility?

What will be an ideal response?

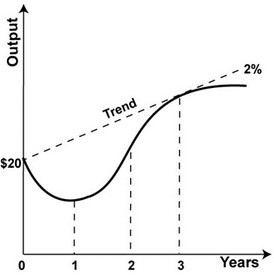

Refer to the graph. Economic output in year 0 is $20 billion. What is potential output in year 2?

A. $21.2 billion B. $20 billion C. $20.4 billion D. $20.8 billion

Banks lost money during the mortgage default crisis because:

A. of defaulted loans to investors in mortgage-backed securities. B. they held mortgage-backed securities they had purchased from investment firms. C. homebuyers defaulted on mortgages held by the banks. D. of all of these reasons.

The total of consumer plus producer surplus is largest at the market equilibrium.

Answer the following statement true (T) or false (F)