Solve the equation for the unknown quantity.6z + 13 = 5z + 5

A. -8

B. -18

C. 8

D. 18

Answer: A

You might also like to view...

What is the biggest criticism of the Piagetian perspective?

What will be an ideal response?

Currently (in August, 2017), Abby wants to have $20,000 available in August 2021 to make a college tuition payment. To be able to have this amount available, Abby will make equal annual deposits in an investment account earning 12% annually in August 2017,2018,2019,2020,and 2021. What is the annual amount to be deposited?

A. $5,548 B. $4,000 C. $3,148 D. $2,270

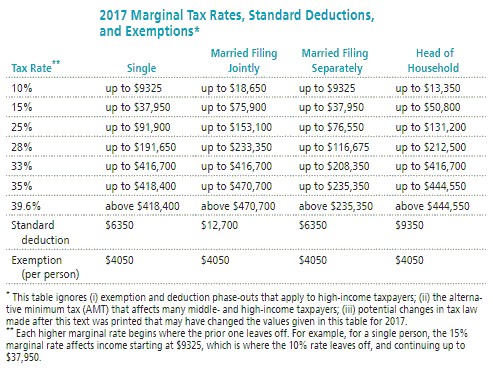

Solve the problem. Refer to the table if necessary. You are single and have a taxable income of $61,855. You make monthly contributions of $540 to a tax-deferred savings plan. Calculate the effect on annual take-home pay of the tax-deferred contribution. If necessary, round values to the nearest dollar.

You are single and have a taxable income of $61,855. You make monthly contributions of $540 to a tax-deferred savings plan. Calculate the effect on annual take-home pay of the tax-deferred contribution. If necessary, round values to the nearest dollar.

A. Take-home pay will be $2160 more per year with tax-deferred plan B. Take-home pay will be $2160 less per year with tax-deferred plan C. Take-home pay will be $1620 less per year with tax-deferred plan D. Take-home pay will be $1620 more per year with tax-deferred plan

Suppose you borrow money from your parents for college tuition on January 1, 2013. Your parents require four annual payments of $1,000 each, with the first payment due on January 1, 2017. They are charging you 6% annual interest. What is the cost of the college tuition?

A. $2,909.37 B. $1,593.85 C. $4,000.00 D. $2,744.69